31-05-2025

12 Types of Invoices With Examples Every Business Must Know

This guide helps you understand when and how to use each invoice type, with practical examples and tips to simplify your billing process. Powered by Shoppeez.

Invoices are an integral part of any business, irrespective of its industry or scale.

From proforma to recurring and credit to overdue, each invoice serves a purpose that helps business owners assess their ongoing operations.

Whether you’re running an online store or a retail supermarket, processing orders, generating bills, or managing inventory, understanding the different types of invoices is crucial.

Let’s break down one by one.

12 Types of Invoices Every Business Should Know

Here are the multiple business invoice types that you can create for clients depending on your requirements:

1. Proforma Invoice

A proforma invoice is an estimated invoice sent by the seller to the buyer before a sale is finalized or goods or services are delivered.

It essentially serves as a preliminary quote, or rather a bill, that helps the receiver understand the approximate value of the particular item they intend to purchase.

The invoice contains the item & quantity details, estimated cost, taxation figure, delivery period, etc.

Shoppeez Tip: A proforma invoice is not legally binding for accounting, taxation, or payment as the sale of goods or services has not yet taken place.

Example: A distributor from Hyderabad has requested an estimation for 3 cartons of ceramic mugs. You send him a proforma invoice stating the item name, pricing [mentioning taxation, shipping, miscellaneous charges], and delivery & payment terms.

2. Sales Invoice

The term “sales invoice” is self-explanatory. It’s the invoice issued by the seller to the buyer stating the delivery of goods or services.

This invoice contains the invoice number, buyer & seller details, date, item description, price, tax, total amount, and payment terms that could be cash, digital, or via cheque.

Often, business owners get confused between a ‘sales invoice’ and a ‘standard invoice’.

Here’s the difference:

A ‘Sales Invoice’ is specific, clearly stating that a transaction between two parties has taken place. Whereas, a ‘Standard Invoice’ is a more standard accounting term.

However, both are legally binding and are used interchangeably.

Example: A buyer buys 700 pairs of formal shirts, and after dispatch, you issue a sales invoice mentioning item details, pricing, etc., thus raising a payment request.

3. Credit Invoice

A credit invoice is issued to reduce the amount the customer owes.

This usually happens when the customer returns the product for any reason, has been overbilled, or has been offered a discount after billing.

Also, it demonstrates that the seller acknowledges the amount owed and issues a type of credit to the buyer, as it helps maintain smooth customer relations.

Example: A seller accidentally charges and sends an invoice for 10 sheets instead of 5. Later, he issues a credit note/memo/invoice to rectify the overcharged amount and refund the extra amount charged.

4. Debit Invoice

A debit invoice is issued when the buyer or customer owes more than what they paid.

Now, this could be due to multiple reasons, such as additional delivery charges, an increase in the prices of goods invoiced, or extra services not mentioned in the original invoice.

It’s an adjustment to the originally raised invoice and has eventually increased the total amount owed by the buyer to the seller.

Example: After the order was dispatched, there was an additional surcharge, occurred due to a pricing change, to be charged by the seller to the buyer.

5. Overdue Invoice

As the name suggests, an overdue invoice is sent by the seller to the buyer/customer over non-receipt of payment as mentioned in the sales invoice.

When the buyer fails to make the payment before the expiry date, the sales invoice becomes overdue.

Generally, it contains the details of the attached original invoice alongside the late payment terms + penalty or interest charges if any.

In this situation, the seller can either send payment reminders, sue the buyer through legal action, or abandon the invoice.

Example: Your customer hasn’t cleared your raised invoice even after 2 weeks of the expiry date. So, you send an overdue invoice citing the late payment charges alongside another gentle reminder

6. Retainer Invoice

A retainer invoice comes into play when the buyer/client pays in advance for the services he hasn’t yet utilized by the seller.

It’s common with agencies, consultancy services, etc., where the seller raises a retainer invoice and the buyer accepts it, thus locking the latter’s service availability for the future.

Example: A SaaS company pays $200 every month and reserves your marketing services in advance. Your agency sends a retainer invoice to document and get it processed.

7. Recurring Invoice

A recurring invoice is a type of invoice that is sent to the buyer or customer either on a weekly, monthly, quarterly, or annual basis.

It’s used by businesses offering recurring services such as monthly or yearly software subscriptions, long-term contracts, weekly or fortnightly consultations, etc.

Example: Charging a monthly, half-yearly, or yearly subscription fee for a customized packaging material bundle or a POS billing software, etc., to your buyer.

8. Interim Invoice

Interim invoices are invoices that a seller raises for requesting part payments while working on a certain project, rather than awaiting the full invoice clearance on project completion.

It’s simply billing the recipient of the services in stages, or as the project progresses. Majorly, this system is used for large and expensive projects as it helps break the mighty total amount into small chunks.

Example: You run an app development company and are working on a complete design overhaul in 3 phases.

Before beginning Phase 1, you raise an interim invoice and raise the second after completing Phase 2, with the final invoice scheduled to be raised after the entire project’s completion.

9. Timesheet Invoice

As the name suggests, timesheet invoices are invoices that are issued based on the hours worked.

They include time logs, nature of work, and hourly rates. These invoices are common among freelancers, offshore professionals working in software, supply chain, retail, etc.

A fixed hour charge is pre-decided, post which the individual’s total hours worked are multiplied by the hourly compensation rate to arrive at a figure.

Example: A hypermarket store pays 15$ per hour to workers during festive seasons. At the day’s end, he calculates the number of hours worked by a worker and multiplies it by $15, and raises an invoice accordingly.

10. Expense Report Invoice

An expense report invoice consists of items that are submitted for reimbursement purposes by employees, contractors, etc.

Often, these bills include reimbursement for meals, hotel bookings, travel, fees, etc., and are raised to the seller or employer.

Example: Your 3 employees attended a tech conference outstation on behalf of your company and on returning, have submitted an expense report invoice stating the expense details to be reimbursed by you.

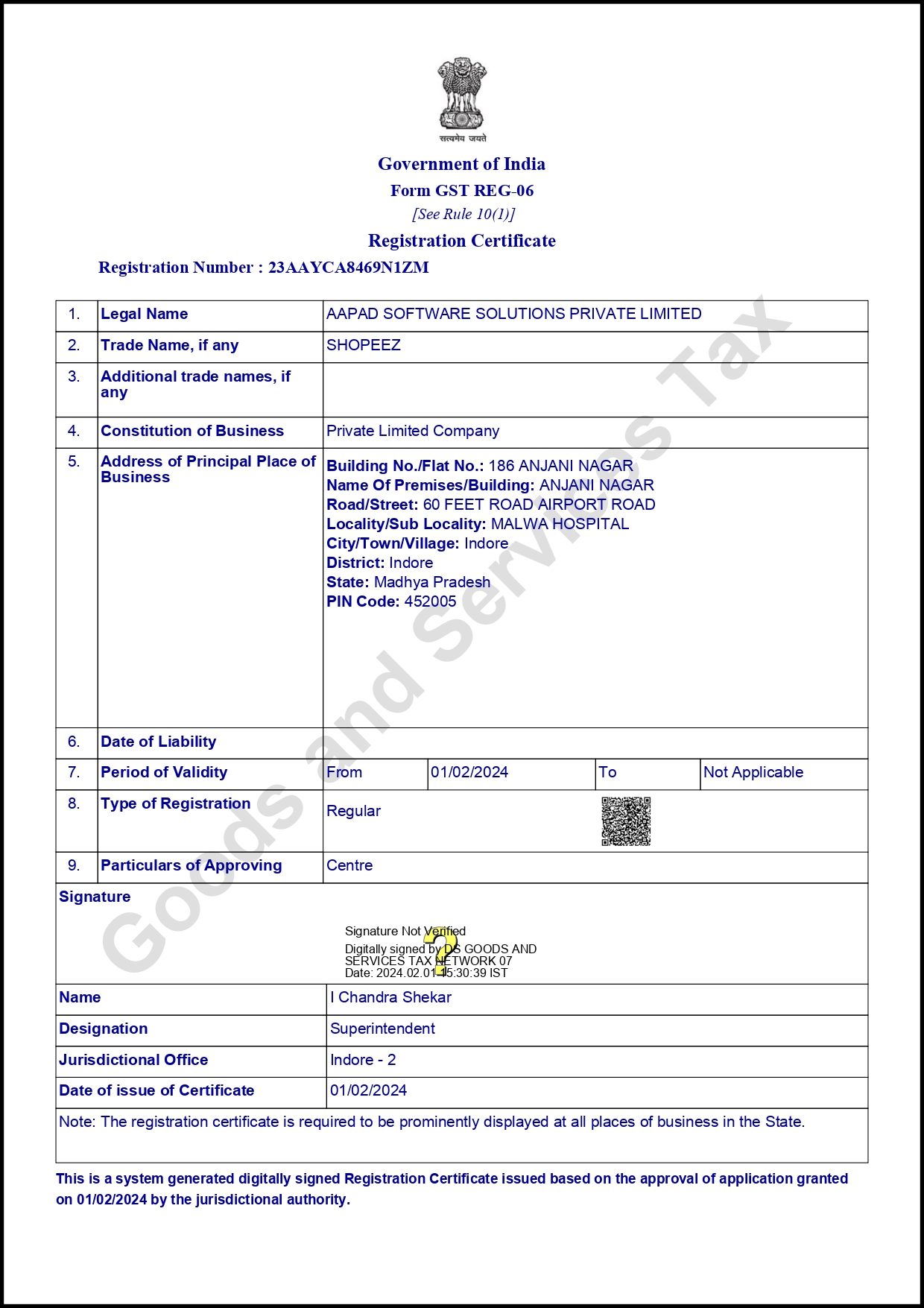

11. E-Invoice

An e-invoice is an electronic invoice that is issued and processed digitally without any manual input.

It’s a GST-compliant invoice that is registered on the Invoice Registration Portal [IRP] with a QR code + IRN.

It’s mandatory for certain businesses dealing in transactions above a certain threshold as per the Government norms, which also allows the authorities to eliminate the occurrence of fake invoices being circulated or filed for taxation.

But what’s beneficial is the seamless feasibility that e-invoices provide as they quickly comprehend the communication between the buyer’s and seller’s accounting systems to generate GST-ready bills.

Verified by the GST Network, it checks for duplication, followed by validation, and later authenticates these e-invoices by assigning them with an Invoice Reference Number [IRN].

Shoppeez Tip: Shoppeez offers an in-built GST billing and invoicing software that eliminates your GST billing and reporting headaches.

Generate quick GST-compliant invoices within seconds and experience a smooth filing experience.

Example: You run an agency and supply services worth INR 9L to a corporate organization. Since it’s a B2B transaction, and your annual turnover exceeds INR 5 Cr, you’re liable to generate an e-invoice via the GST portal.

Next, you enter the invoice details and generate an invoice reference number [IRN], following which you share the final e-invoice with the client.

12. Collective Invoice

The last invoice type is the collective invoice where more than one bills are compiled together and shared as a single invoice.

This is highly feasible for buyers or customers who make smaller purchases but at frequent intervals, say alternate days or weekly.

Since generating single yet repeated invoices for small items, it becomes easy to generate a collective invoice for sellers upon mutual understanding.

Example: You run a B2B retail shop supplying office or stationery supplies to a nearby MNC. Instead of generating a single invoice every 2nd day, you generate a collective invoice fortnightly to summarize all transactions.

Conclusion

Since there are multiple types of invoices, it’s important to understand which types suit and facilitate your business requirements best.

However, the ones mentioned above are quite common with retail businesses; each one holds its importance while dealing with clients.

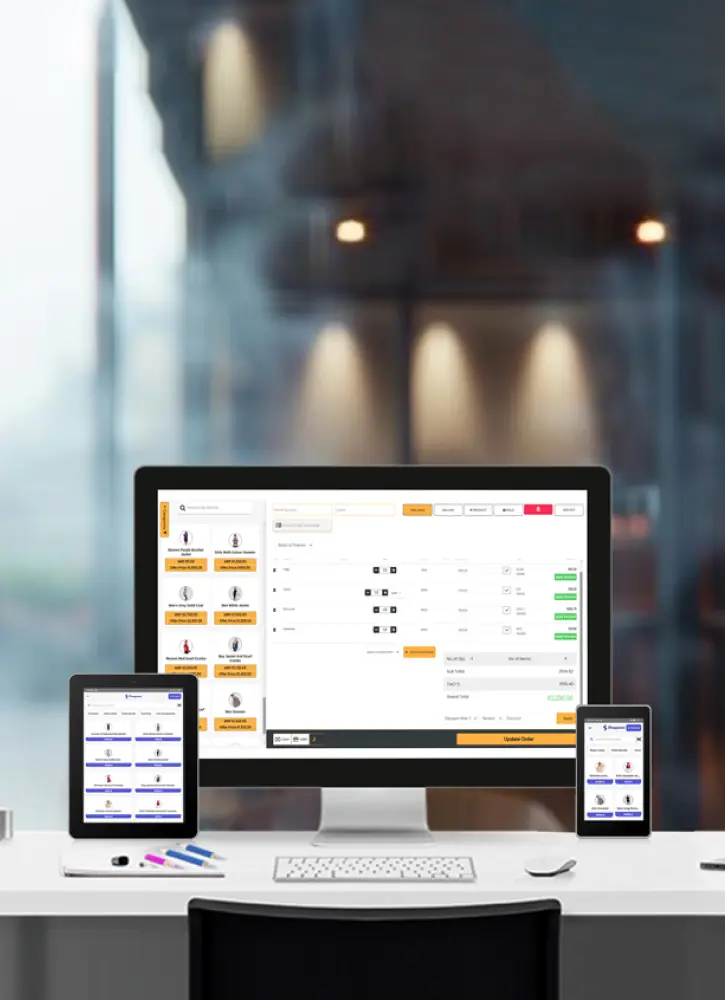

Invoicing is a core part of any business activity, and to ensure it’s done right and tight with zero errors, you require an all-in-one billing software that fulfills your needs.

Shoppeez does that for you, end-to-end. From retail GST billing to AI-powered inventory management and ready-to-edit website templates for online business promotion, everything is taken care of.

Book your free demo today.

31-05-2025

12 Types of Invoices With Examples Every Business Must Know

This guide helps you understand when and how to use each invoice type, with practical examples and tips to simplify your billing process. Powered by Shoppeez.

Read More

23-05-2025

What is POS in Retail? Why Retailers Need POS Systems

POS systems simplify retail by enabling quick billing, real-time inventory, and automated reports. Shoppeez POS boosts efficiency across all store types.

Read More

29-11-2024

What is Balance Sheet and How to Understand It?

Balance Sheet is a financial statement that provides a snapshot of a company's financial position...

Read More

21-11-2024

What is the Difference Between Debit Note and Credit Note in GST?

A debit note in GST is a document issued by a customer to inform the vendor about an amount that has been debited from their accounts.

Read More

12-11-2024

Complete Guide for the Best Retail Billing Software

Discover top retail billing software to enhance efficiency, sales, and customer experience.

Read More

11-11-2024

Top 5 Benefits of Retail POS Software for Supermarket & Hypermarket

Discover how retail POS software India can transform your supermarket or hypermarket operations. From streamlined transactions to enhanced inventory management.

Read More

27-08-2024

What is an Invoice? And How to create it?

An invoice is a document that is given by the seller to the buyer for the collection of payment. It outlines the details of the cost of the product

Read More

23-08-2024

The Advantages of Pharmacy Billing Software

Pharmacy billing software is essential for medical stores to boost efficiency and streamline checkout processes, which helps reduce wait times for customers.

Read More

20-08-2024

Why Barcode Scanning is Important in Retail Billing Software

Barcode scanning is crucial for businesses because it reduces the likelihood of errors and enhances accuracy compared to manual data entry

Read More

09-08-2024

Difference Between POS Billing Software and CRM System

POS billing software is designed specifically for processing sales transactions but offers much more, On the other hand, CRM software focuses

Read More

06-08-2024

Benefit of Shoppeez Retail Billing Software India

Retail billing software, also referred to as POS (Point of Sale) software, is a digital tool designed to streamline and automate billing processes

Read More

02-08-2024

What is POS Software and How Does It Work?

Discover the Future of Retail with the Best POS Software in India: Ready to revolutionize your retail?

Read More

01-08-2024

Evolution of billing software and what's new in 2024?

Before the invention of billing software, billing was done manually with more effort and time consuming. The modern billing software solution

Read More

31-07-2024

What is Billing software and why does business need it?

Billing software is a type of software designed to simplify invoicing and billing for all types of businesses.

Read More

31-07-2024

7 Reasons Why POS Billing Software is Needed For Retail Businesses

POS billing software is necessary for retail business as it effectively improves the processing of transactions by automating the checkout process

Read More

29-07-2024

Shoppeez Retail Billing Software to Revolutionize Business

The benefits of using a retail billing software is it streamline your business and improves the efficiency, accuracy, and customer satisfaction….

Read MoreDo you have

any questions?

Feel free to send us a message if you have any

questions or book a free demo now!

PHONE

+91 88899 11195OPENING HOURS

24/7